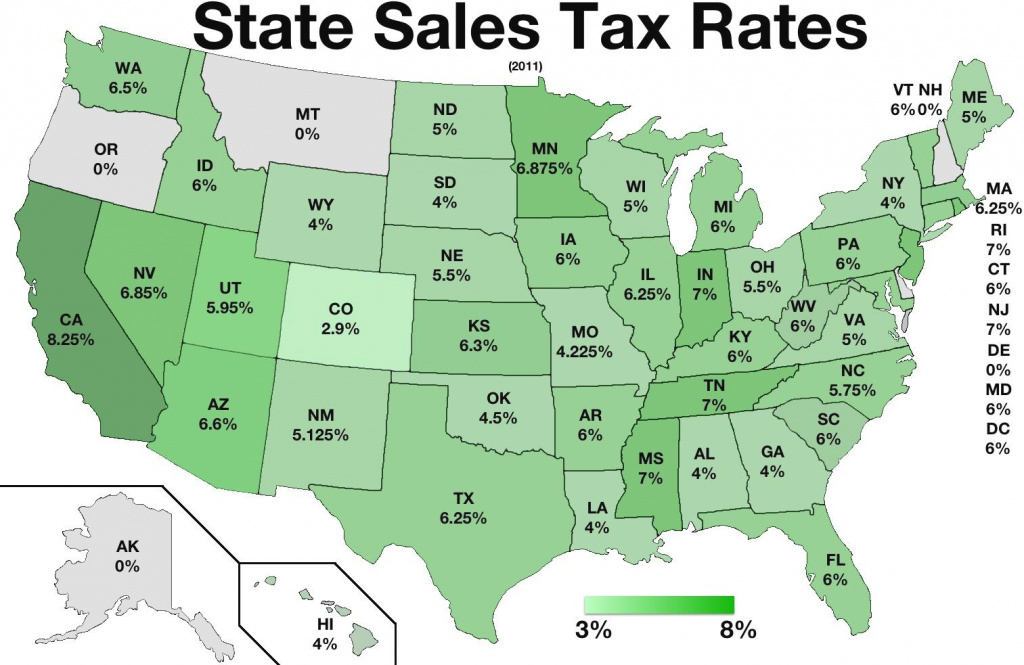

Sales Tax Arizona 2025 - How High Are Sales Taxes in Your State? Tax Foundation, Arizona sales and use tax rates in 2025 range from 5.6% to 11.2% depending on location. There are a total of 99 local tax jurisdictions across the state,. Sales Tax By State Map Printable Map, 2025 guide to state sales tax in arizona. Business codes, region codes, and city codes can be found on the tax rate table.

How High Are Sales Taxes in Your State? Tax Foundation, Arizona sales and use tax rates in 2025 range from 5.6% to 11.2% depending on location. There are a total of 99 local tax jurisdictions across the state,.

Arizona state, county & city sales tax rates 2025.

Az’s combined sales tax rate 2ndhighest in nation, Business codes, region codes, and city codes can be found on the tax rate table. This page lists an outline of the sales tax rates in arizona.

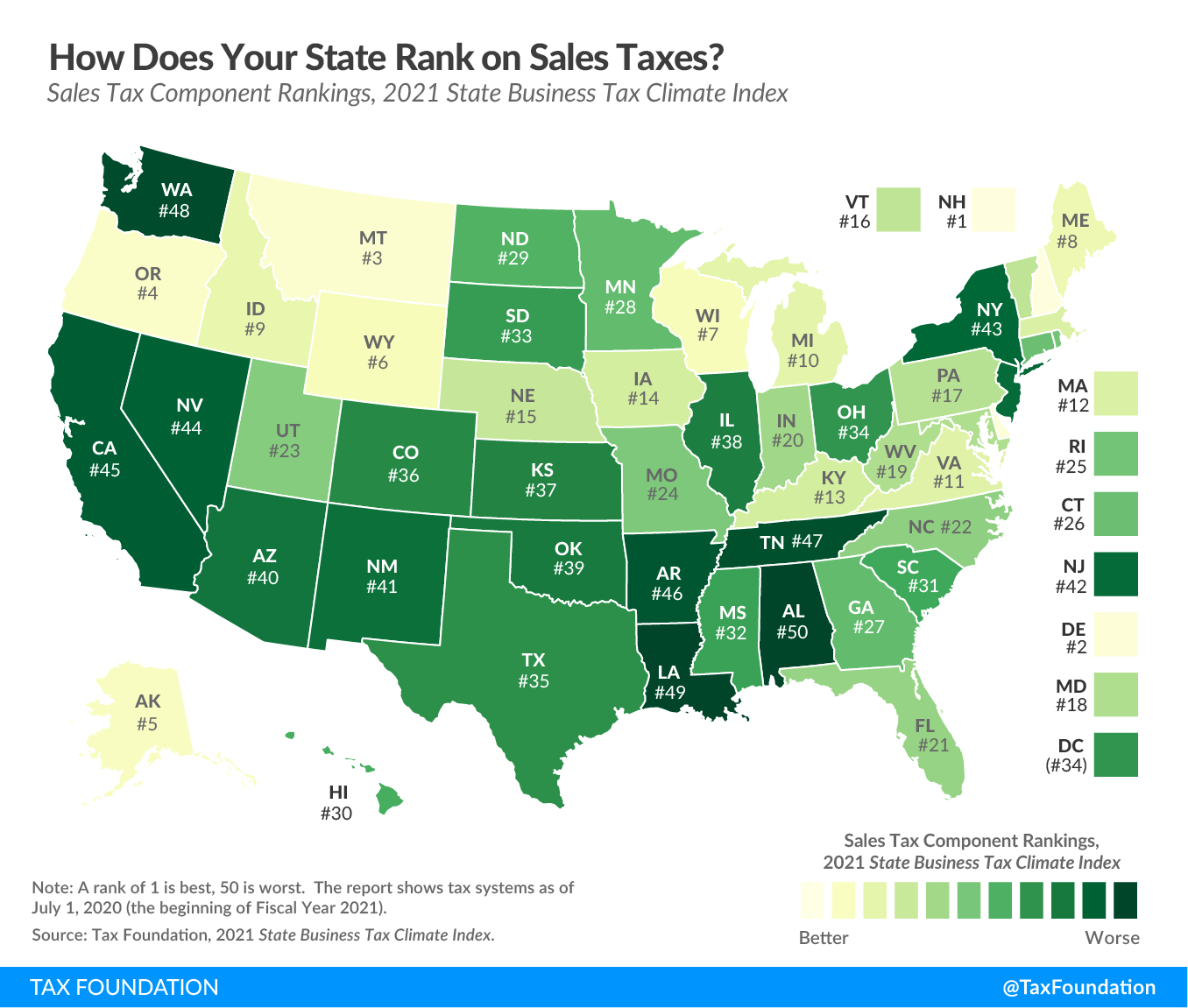

Best & Worst State Sales Tax Codes Tax Foundation, Arizona sales and use tax rates in 2025 range from 5.6% to 11.2% depending on location. Arizona state, county & city sales tax rates 2025.

View a detailed list of local sales tax rates in arizona with supporting sales tax calculator.

How to Get a Sales Tax Permit in Arizona YouTube, Arizona has state sales tax of 5.6% , and allows local governments to collect a local option sales tax of up to 5.3%. 2025 guide to state sales tax in arizona.

Business codes, region codes, and city codes can be found on the tax rate table.

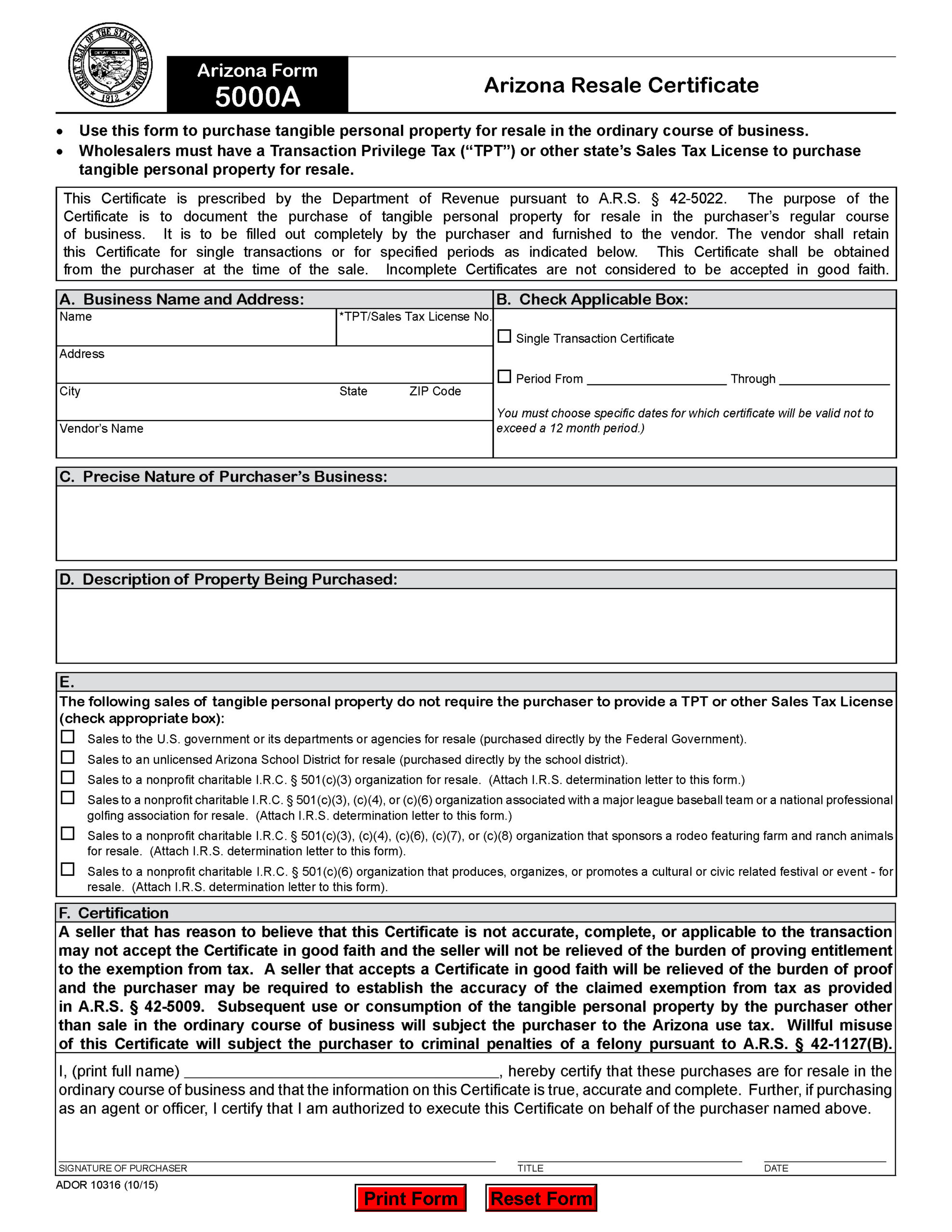

How To Get A Sales Tax Exemption Form Arizona, Arizona state, county & city sales tax rates 2025. Including these local taxes, the lowest sales tax rate in arizona is 5.6% in seventeen cities, including fort mohave and golden valley, and the highest sales tax is 11.1% in tucson.

.png)

Monday Map Combined State and Local Sales Tax Rates, Arizona state, county & city sales tax rates 2025. View a detailed list of local sales tax rates in arizona with supporting sales tax calculator.

Sales Tax Arizona 2025. Arizona sales tax due dates vary based on filing frequency. 2025 arizona sales tax table.

Tpt and other tax rate tables are updated monthly; 2025 arizona sales tax changes.

Tax form az Fill out & sign online DocHub, There are a total of 99 local tax jurisdictions across the state, collecting an average local tax of 2.422%. Arizona sales tax due dates vary based on filing frequency.

Although commonly referred to as a sales tax, the arizona transaction privilege tax (tpt) is actually a tax on a vendor for the privilege of doing.

2025 Arizona Sales Tax Guide, Including these local taxes, the lowest sales tax rate in arizona is 5.6% in seventeen cities, including fort mohave and golden valley, and the highest sales tax is 11.1% in tucson. Business codes, region codes, and city codes can be found on the tax rate table.

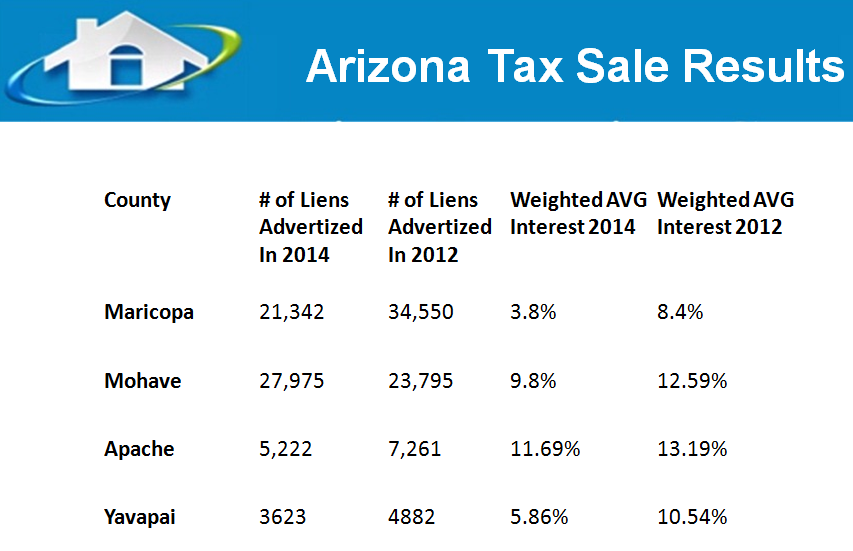

Results From The Arizona Online Tax Lien Sales Tax Lien Investing Tips, Arizona sales and use tax rates in 2025 range from 5.6% to 11.2% depending on location. Arizona sales tax due dates vary based on filing frequency.